Our leading computer programmers have worked collectively to develop the PDF editor that you're going to operate. The app makes it simple to submit irs form 1088 documents shortly and with ease. This is everything you should do.

Step 1: Look for the button "Get Form Here" on this webpage and click it.

Step 2: Now you are on the file editing page. You may edit, add text, highlight particular words or phrases, place crosses or checks, and put images.

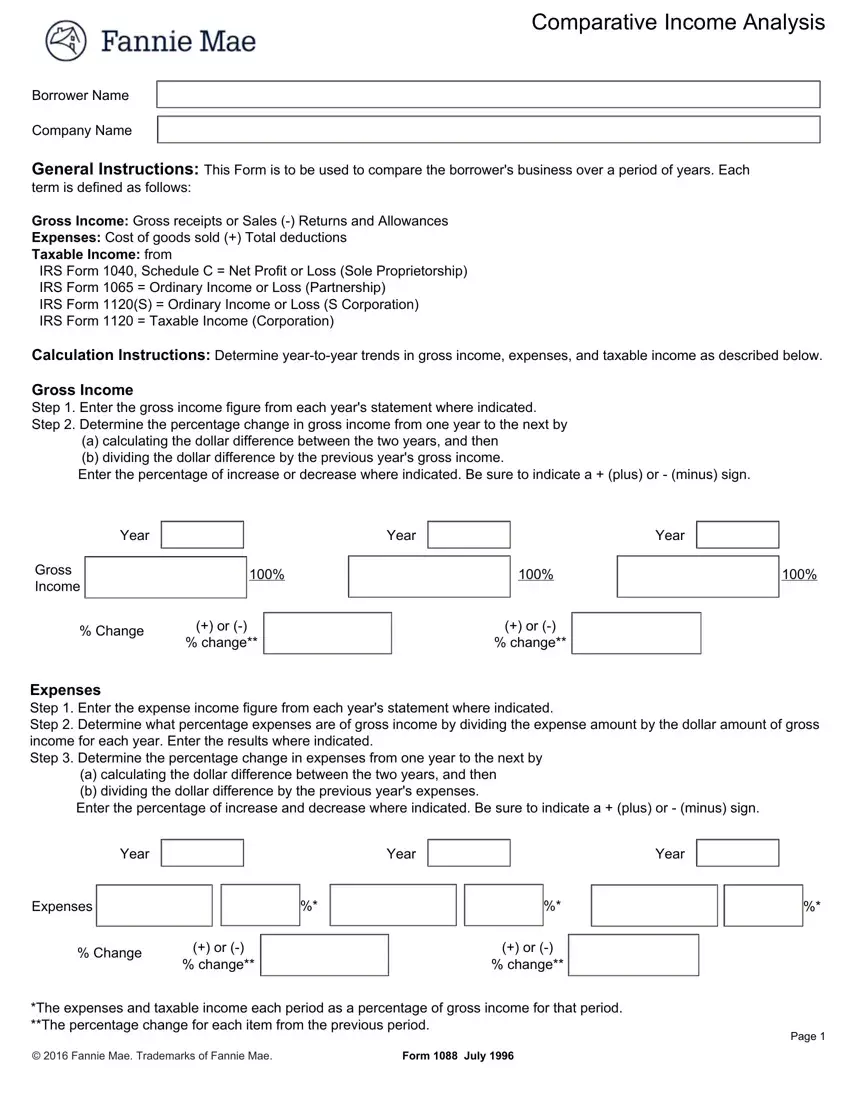

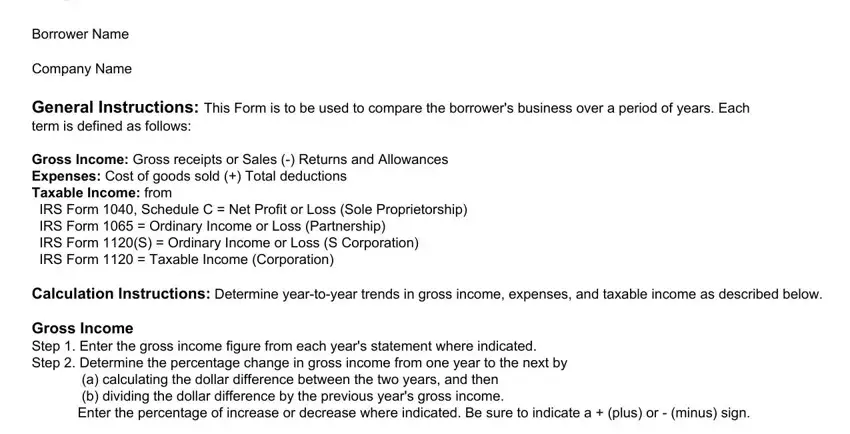

It is essential to provide the following information if you need to create the document:

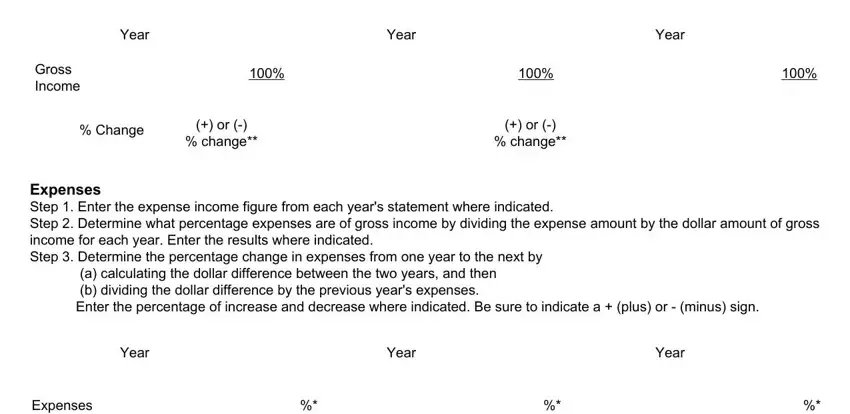

The software will expect you to complete the Year, Year, Gross Income, I I, or change, Change, or change, Year, Expenses Step Enter the expense, Year, I I I I ID, Year, Expenses, and Year area.

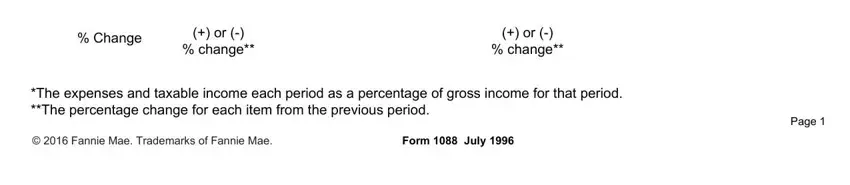

In the I I I I ID, Change, or change, or change, The expenses and taxable income, Fannie Mae Trademarks of Fannie, Form July, and Page part, highlight the vital particulars.

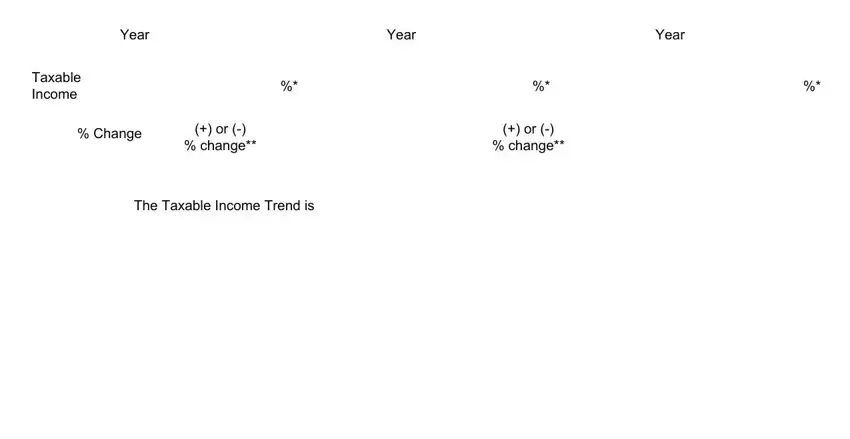

You have to identify the rights and responsibilities of all parties in paragraph Year, Year, Year, Taxable Income, ID I, or change, or change, Change, and The Taxable Income Trend is.

Finish by reviewing these areas and writing the appropriate details: Instructions, Comparative Income Analysis The, Copies Original, Printing Instructions This form, Instructions The lender should, Gross Income equals Gross receipts, and Expenses equal Cost of goods sold.

Step 3: Hit the Done button to save the document. So now it is obtainable for export to your gadget.

Step 4: Have minimally a few copies of your document to keep clear of any kind of potential concerns.